Examination of market psychology in relation to Bitcoin (BTC): Understand the mind behind cryptocurrency

The world of cryptocurrencies has quickly evolved since its inception in 2009. Among digital currencies, it stands out from its mass implementation and broad recognition: Bitcoin (BTC). BTC has become a reference point for many other digital assets. But what drives the behavior of investors, merchants and users who participate in this extensive online community? In this article, we are considering the kingdom of market psychology to understand Bitcoin's performance thinking processes.

What is market psychology?

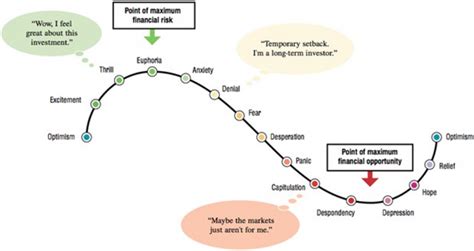

Market psychology refers to underlying motivations, emotions and behaviors that affect investors' decisions. It covers a variety of psychological factors that influence how people detect, evaluate and respond to marketing opportunities and risks. In relation to the cryptocurrency market, market psychology plays a crucial role in price design, investors' opinions and the general market development.

Bitcoin Psychology

The Bitcoin market has been strongly labeled in speculation, hyps and volatility over the years. Several psychological factors have influenced their exceptional performance:

Feame and Group : The cryptocurrency market has experienced intense periods of fear (for example, 2017) followed by episodes of euphoria (for example, 2020). Investors who are "greedy" (that is, willing to run a significant risk for potential yields) have promoted the increase in the price of Bitcoin. In contrast, those who are afraid (for example, uncertainty about the future of the market) have led to a decrease in purchases.

Scarcity mentality

: Bitcoin's limited supply (around 21 million currencies) has created a feeling of shortage among investors. This observed shortage has increased demand and subsequent prices.

Social test : The growth of the cryptocurrency ecosystem has encouraged many participants to follow the audience. The social media platforms, online forums and communities have improved the impact of popular opinions, which often leads to greater adoption and investments in Bitcoin.

Risk betting behavior : Bitcoin's volatility has caused some investors to take excessive risk, which leads to significant losses when prices vary significantly.

Commercial Psychology

For merchants, market psychology can be a blessing and a curse:

FOMO (fear of missing) : The fear of addressing potential commercial opportunities or market development has caused many merchants to invest a lot in Bitcoin.

2

Confirmation deviation : merchants generally focus on positive signals and pass the negative, which leads to biased decision making.

User Psychology

The Bitcoin user base is versatile, but certain psychological factors form their behavior:

Feeling : Bitcoin has existed for more than a decade, so it is a family property for many users.

Security anxiety : The security risks associated with the storage and management of cryptocurrencies have led some users to invest in Bitcoin.

Community commitment : The interaction of the Bitcoin community through social networks and online forums can promote loyalty and promote investment.

conclusion

Market psychology plays an important role in the modification of investors, merchants and users who participate in the cryptocurrency market. By understanding these psychological factors, we can better sail in the complexities of the Bitcoin market and make more conscious decisions. Although some people have benefited from the increase in the price of Bitcoin, others have suffered significant losses.